Understanding TB Risk in Pastoralist Communities in Ethiopia

Fraym conducted a geospatial analysis in support of GIZ Digi#ances to understand the relationship between digital payment infrastructure and the key populations that these services are intended to serve, namely refugees and vulnerable Jordanians.

In Jordan, there are more than 760,000 registered refugees. However, the actual total is estimated to be around 1.3 million refugees when accounting for those not registered.

Access to financial services is critical for refugees, but at present, it is difficult for refugees to open bank accounts in Jordan. The Digi#ances project, which is implemented by the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, commissioned by the German Federal Ministry for Economic Cooperation and Development (BMZ) aims to improve access to remittances and other financial services through digital solutions in Jordan.

Through consultation with GIZ and external stakeholders, it became apparent that women were especially important, as they face particular challenges when interacting with digital payment infrastructure. Furthermore, we know there is a gender gap in financial inclusion. The latest figures from the Global Findex find that the gap in account ownership has fallen to six percentage points from nine percentage points, where it hovered for many years.

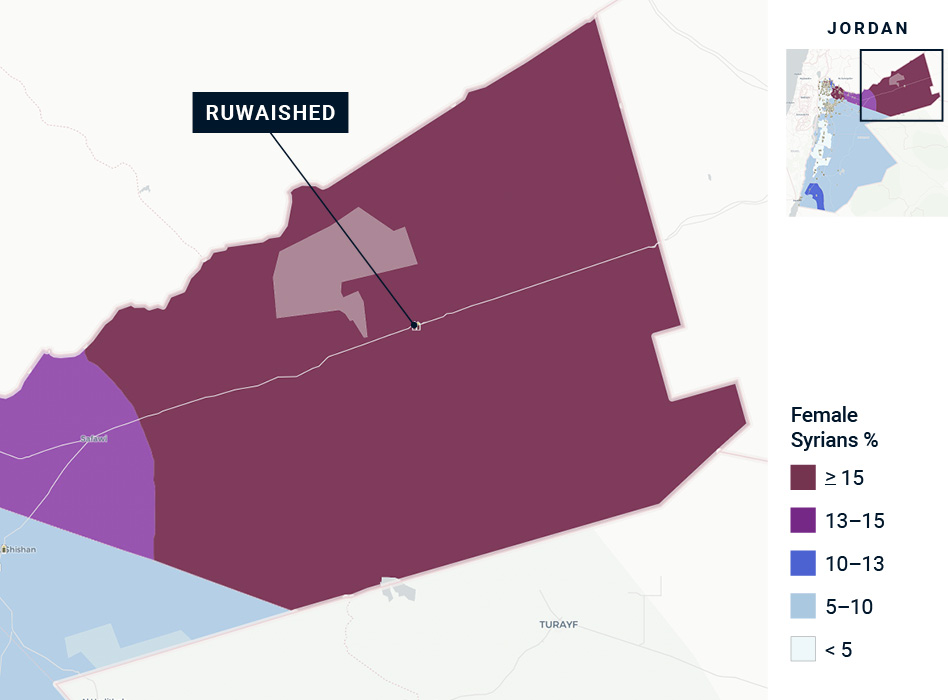

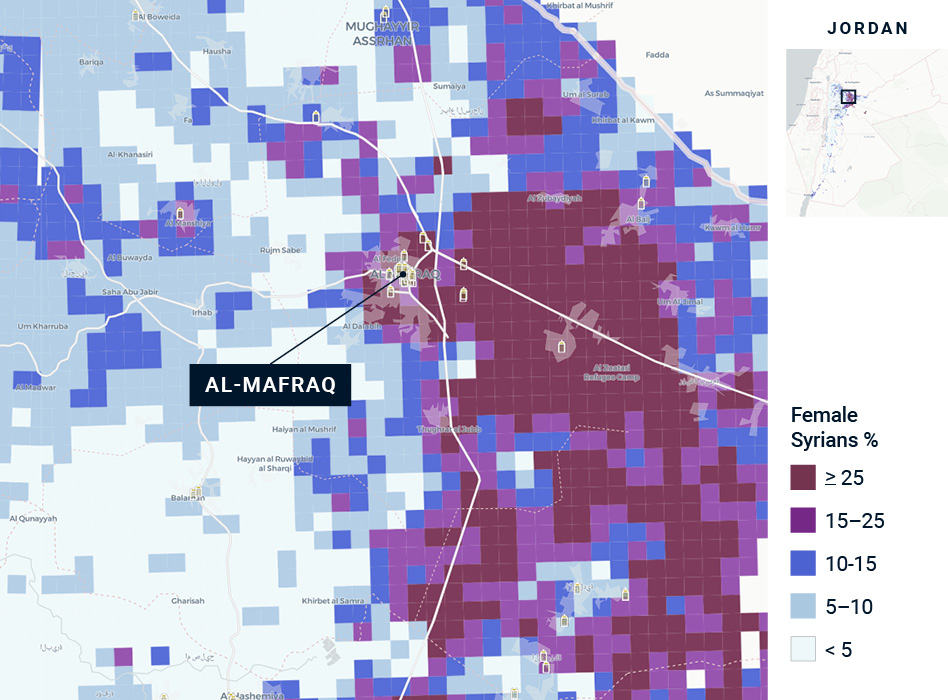

As a result, Fraym was able to provide data for both female refugees and financially vulnerable women. Using the female Syrian refugee population, dashboard users can identify gaps in access through looking at the driving distance to agents. Specifically, users can identify areas with large populations of female Syrian refugees and limited access to agents.

There are only two agents in the district, resulting in an average driving time to agents of just over 30 minutes.

In the city of Mafraq, one-quarter of the people are Syrian refugees – about 125,000 people. There are only 63 agents in the city, mostly in the city center. The ratio between agents and target populations is roughly 500 Syrian refugees per agent, which presents a potential challenge for liquidity when beneficiaries use agents to cash out.

M

financially vulnerable Jordanians

K

UNHCR-registered refugees use mobile wallet for assistance

%

gender-gap in mobile phone ownership among Syrian refugees

First, Fraym defined and then mapped the key target populations of digital financial services. The most important group was refugees. Using data from UNHCR, Fraym looked at UNHCR-registered refugees who currently receive assistance through mobile wallets. This target population is a current beneficiary of digital payments.

In addition, Fraym looked at financially vulnerable Jordanians. To define financial vulnerability, Fraym developed an index that encompasses access to financial services, the means to access financial services, and familiarity and usage of the banking system. Then, Fraym segmented the population to identify the most financially vulnerable. Next, Fraym incorporated various financial access points (agents and ATMs) to assess their availability in relation to where refugees and vulnerable Jordanians are.

“Everyone is focusing on refugees but few knew exactly where they are – this was the first time we saw it mapped. The mapping of the refugee location against the mobile money financial infrastructure made the gaps immediately visible for everyone involved (e.g. private sector & humanitarian organisations). This was so useful because it’s easily digestible – easier than statistical analysis”