Build Effective Social and Behavior Change Strategies

Infrastructure investments are transforming and accelerating economic and social opportunities for millions of people across Africa. Infrastructure lights up homes, spreads information, speeds up travel, and facilitates trade. Last week, Fraym CEO Ben Leo discussed the transformative power of these investments at the Harith Business Day African Infrastructure Dialogue in Cape Town, South Africa.

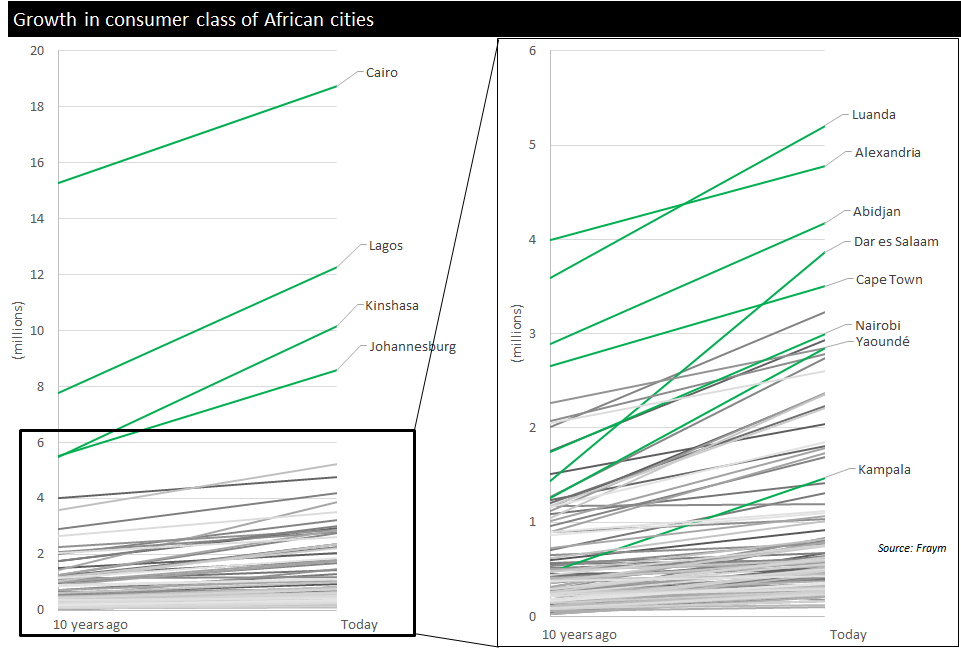

In his remarks, Ben highlighted how the dramatic rise of African consumer power – especially within the continent’s largest and most networked cities – is the heart of the infrastructure investment opportunity. For example, Lagos and Kinshasa each added more than 4 million to their ‘consumer classes’ in the last decade. Cairo added another 3.5 million. Fourteen other African cities added at least a million consumers each—including Abidjan, Nairobi, and Yaoundé.

These new consumers are the people who increasingly demand reliable and affordable electricity and internet. They require world-class intermodal transport networks like ports, roads, and railways to move the goods they purchase. Meeting these rapidly growing demands will require a great deal of new infrastructure investments across the continent. Moreover, the scale of the opportunity—and its challenges—clearly calls for a significant increase in private investment alongside enabling public sector policies.

To illustrate this opportunity, Fraym partnered with the continent’s premier infrastructure investment fund manager, Harith General Partners, to demonstrate how strategic infrastructure investments transform the economic and social trajectory of entire cities, countries, and regions. The flagship report – entitled Infrastructure as a Disruptor: Leveraging Private Capital for Growth – is the first to provide city and neighborhood level data focused specifically on the telecommunications, power and transport sectors in Africa.

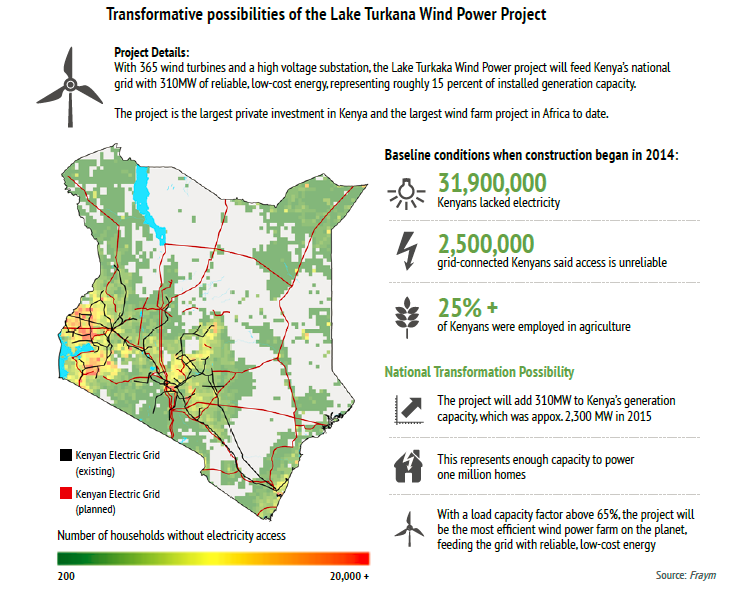

The report looks at investments like the Lake Turkana Wind Power Project, the largest wind farm project in Africa to date. When construction began in 2014, 85 percent of people living around Lake Turkana lacked electricity. The project will provide Kenya’s national grid with reliable, low-cost energy and has the capacity to power one million homes.

History demonstrates that major infrastructure investments like these have the potential to disrupt entire economies and produce step-change societal improvements. Infrastructure as a Disruptor: Leveraging Private Capital for Growth showcases projects across the continent that have – or will – deliver just this. By using hyperlocal data to identify and project demand, investors can find similar opportunities on the horizon.

Download Infrastructure as a Disruptor: Leveraging Private Capital for Growth here. For an overview of the report, see our Executive Summary.