Build Effective Social and Behavior Change Strategies

Anyone who aims to maximize their business opportunities in Africa will have to capture the informal trade. A 2017 IMF Paper found that Sub-Saharan Africa’s informal economy remains among the largest in the world, with informal borrowing and trade accounting, on average, for 40% of total economic output. The sheer scale of the sector inevitably makes it a vital concern for commerce.

The challenge for consumer product companies is knowing where (and to whom) they could be selling via the informal sector. Instead of categorizing these places as dead zones—let’s view them as underserved markets with significant (if previously unknown) potential.

Typically, CPG companies have a strong understanding of where their distributors are already taking product in Africa, and how many units they are placing at the end of the supply chain. However, these same companies struggle to know who would be buying their product if they had the opportunity. The companies who can identify this latent demand and capture these emerging consumers will achieve the greatest growth in Africa.

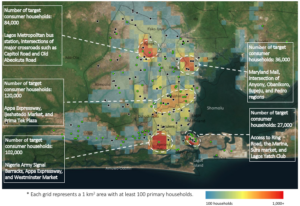

Geospatial data analytics is one way to bring these “blind spots” into focus and help consumer-focused companies maximize their potential. A data-driven approach should jettison vague assumptions about consumers in Africa, and rely on a combination of robust data to produce accurate, sought-after insights about very specific areas.

For example, Fraym would begin by establishing an ideal consumer profile through the use of several datasets on family size, age, employment status, disposable income and, crucially, spending habits in relation to particular goods categories. Then, we’d enrich the picture of the target area, and its inhabitants with satellite imagery. This comprehensive approach, can create a sense of what consumers look like, how much they spend, and where they move and concentrate—providing more precise, local-level insight for an informal market than has ever previously been feasible.

Africa is a vast continent with space for both formal and informal trade. To really seize the opportunity, though, a well-rounded understanding of local markets is necessary – especially the rural ones. The granular data and insights achieved through geospatial data analytics provide consumer-focused companies with the nuanced and hyper-local knowledge that they need. With that knowledge, companies can optimise their distribution, set appropriate targets, unlock new areas, and overcome early barriers to entry. Consumer-focused companies who lean forward on these data-driven approaches will see outsized growth in Africa in the years to come.