Build Effective Social and Behavior Change Strategies

As Europe and the United States start to reopen, the toll of COVID-19 has already been enormous, principally the harrowing loss of life, but also the economic standstill. In Africa, there’s still uncertainty about what happens next – will countries be spared the worst or is the dam about to break? While hoping for the former and preparing for the latter, Nithio and Fraym are partnering to better assess vulnerability to COVID-19 and the impact on the off-grid solar sector.

As the COVID-19 crisis hit, the off-grid solar community quickly rallied to create the Energy Access Action Network and raise a relief fund to help keep the sector afloat. GOGLA, Sustainable Energy for All, and others surveyed the off-grid solar providers and found that most would need assistance to survive if the crisis lasted more than a couple months. For off-grid providers to plan, they need to know how this will impact their customers’ ability to pay and how that will in turn impact their cash flows.

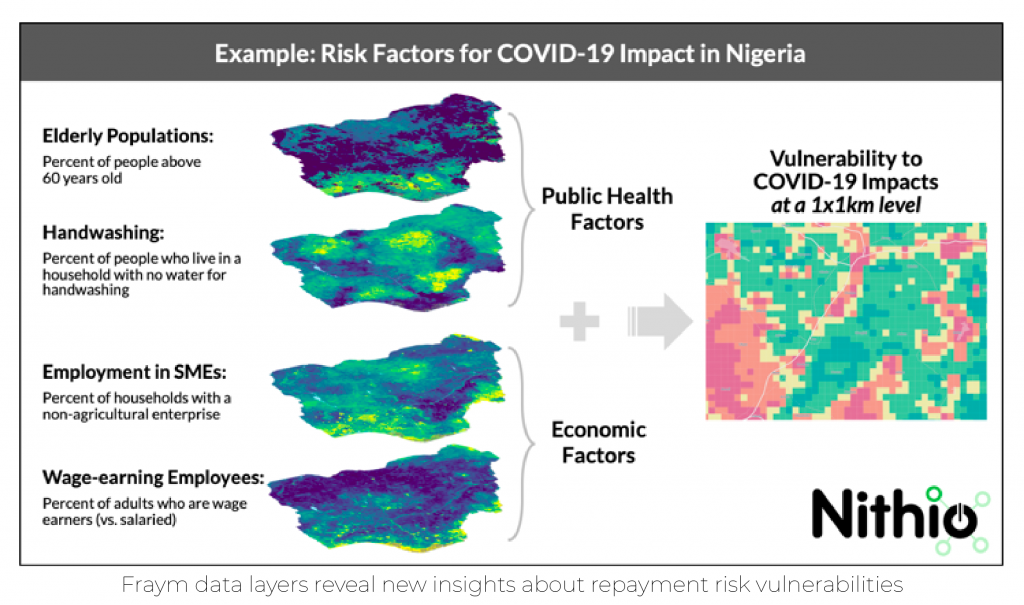

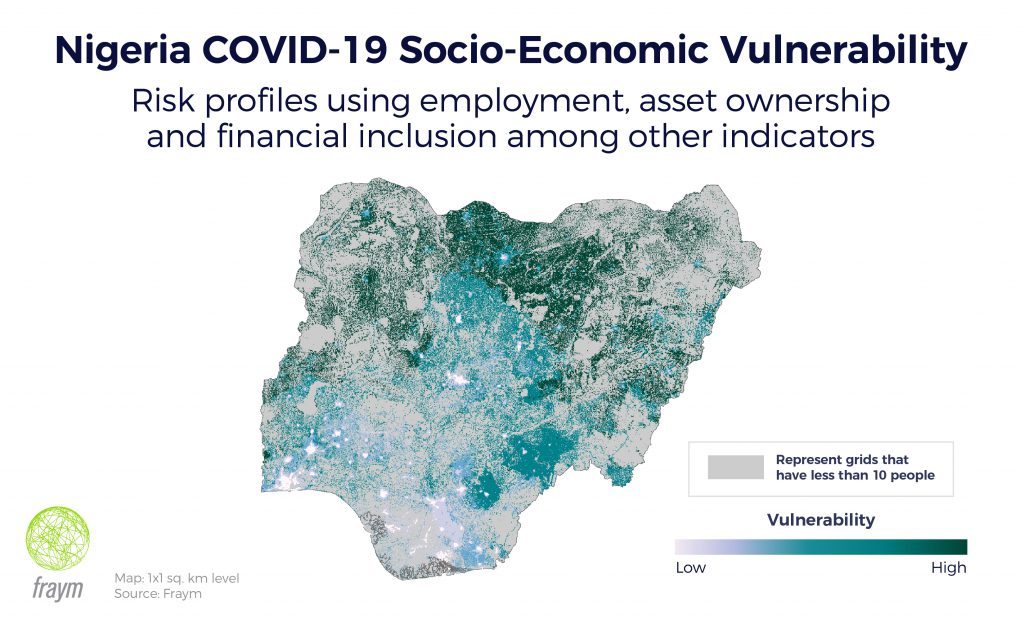

Nithio, working with Fraym, is updating its credit risk assessment models to reflect the likely impacts on payments due to stay at home orders and household vulnerabilities. Typically, Nithio’s model shows the likely payment trajectory of a household, making it possible for companies and investors to understand the value of a receivable as well as predict likely cash flows over time. With COVID-19, or any shock to the market, these models need to reflect a new reality.

COVID-19-related disruptions to the model may arise through different components of the shock:

Data from Fraym can help reveal which households might be most vulnerable by identifying characteristics that are correlated with either spreading or succumbing to COVID-19, which Nithio uses to update its models. While early changes to the model are based on assumptions about what will happen next, we are continually updating them as new information becomes available.

Nithio’s business model is based on the premise that once you understand credit risk you can plan for it. This holds true for crisis response. Companies, investors, donors need to understand how COVID-19 will impact customers and cash flows so they can design support mechanisms that ensure continuity of business. This response isn’t just about keeping businesses running, it’s about keeping local workforce’s employed and, most importantly, keeping the lights on for households that desperately need them.