Build Effective Social and Behavior Change Strategies

Large, established banks across the African continent face an existential consumer market threat. Unconstrained by legacy infrastructure and expensive brick-and-mortar branches, countless innovators are providing home-grown mobile transfer solutions and rapidly capturing share, particularly amongst mass market consumers. Most of these solutions originate with major telco providers, like Safaricom, MTN and Airtel. But, they are not alone. Other fintech start-ups like Paga in Nigeria are growing in leaps and bounds.

How are they achieving meteoric growth? Knowing their customer, providing home-grown solutions to specific pain points, and operating with lean, distributed retail infrastructure. They have conviction that mobile and digital banking is the future. And they’re making out-sized bets to capture it.

There is no question that large traditional banks – whether international or local – must meet this growing threat head on. Yes, they can continue to rely upon tried-and-true business lines, like lending to large enterprises, capturing margins between savings and t-bill rates, and handling public sector payroll transactions. However, the old way of doing business means ceding the massive consumer opportunity.

Africa’s emerging and expanding middle class is demanding premium everyday products. And, when it comes to banking, much of this population is under-served. With their growing incomes and technical savvy, understanding this demographic is essential for mobile and digital banking providers.

At Fraym, we have worked with several large banking institutions that understand these mega trends. This includes a major player in West Africa looking to capture the growing segment of first-time account holders. Fraym identified communities and neighbourhoods with large concentrations of consumers on the cusp of adopting financial accounts, which could be captured through distributed agent bankers and new products.

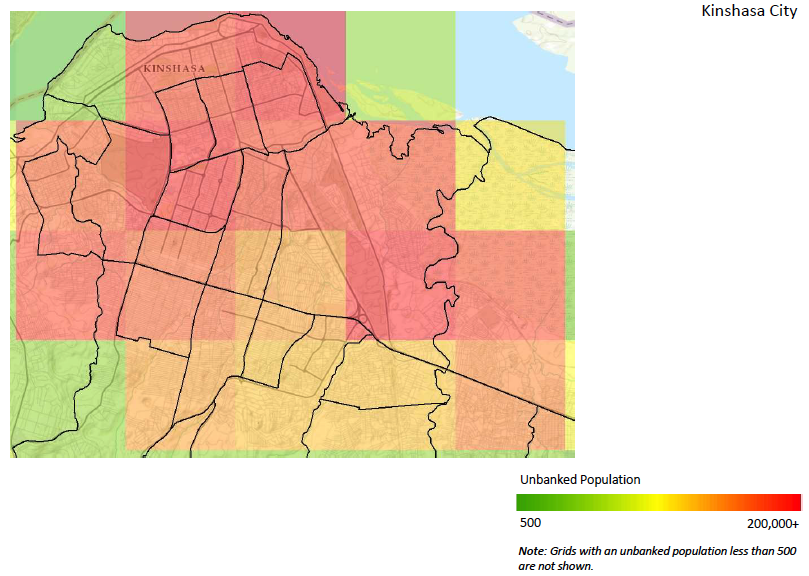

Four thousand kilometres away, Kinshasa has more than 10 million residents and less than a third have access to a bank account. Here, Fraym worked with another financial institution to identity neighbourhoods in which to deepen their agent networks and meet account growth targets. Using hyper-local information, Fraym identified neighbourhoods with concentrations of ‘look-alike’ consumers that matched the profile of high adopters elsewhere in Kinshasa.

It’s the combination of household survey data and geospatial imagery that helps banks size consumer markets with precision, and inform strategic investment decisions. Precise, localised data answers questions like, which people in a given region have access to mobile phones? Of these, which can use smartphone apps, and which have feature-phones that make solutions like USSD their only real mobile banking option? Who has the earning capacity to warrant the use of such products, and who does not? These are the questions that new players in banking markets must be able to answer if a digital product launch has any hope of success.

Surveys that focus on target customers’ age, income, attitudes and education level also have much to reveal about their readiness to adopt digital banking solutions. As well as their levels of trust in such products, which is a critical ingredient to adoption. In populations where trust is low, a bank might decide to open a physical branch to support the complimentary rollout of digital services, while more fluent internet users may never want to see a physical branch at all.

Competition between banks is heating up, and Africa’s growing middle class represents a golden opportunity for expansion – if they play their cards right.

Digital services are the missing piece of the puzzle when it comes to financial inclusion for African communities, particularly for traditional banks facing such an existential consumer market threat. But entering a deeply nuanced marketplace without a sense of local social and economic context could do these organisations more harm than good. Like so many business ventures, it is the banks’ ability to incorporate user data, lifestyles and preferences into their growth strategies that will ultimately spell success or failure.