Build Effective Social and Behavior Change Strategies

Kupanda Capital recently partnered with Fraym to support their work on energy access and finance. Many companies and investors are working aggressively to bring market solutions to over 600 million people across Africa who lack access to the electrical grid. While the gap is obvious, the challenge is knowing which products and solutions are right for which people, and how to finance them.

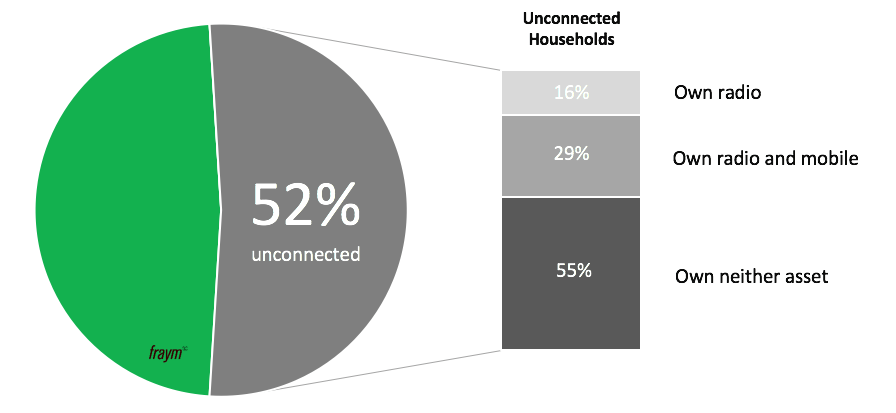

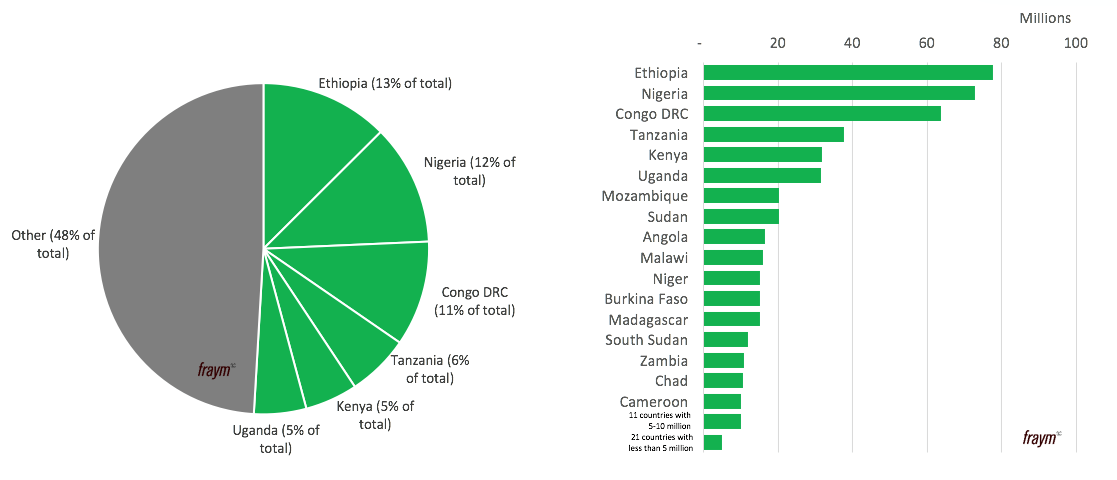

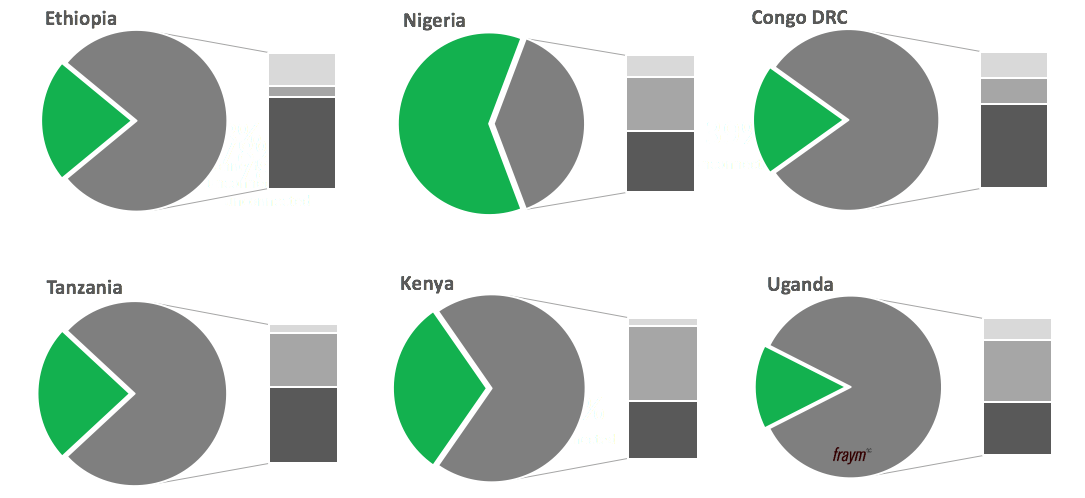

Unconnected Population by Country

A multitude of factors prevent the ability to meet this goal as rapidly and efficiently as needed. Fundamentally, the sector has been able to identify issues of supply but, off-grid companies still haven’t figured out demand: Who are the people without access to reliable energy and where are they located? But most importantly, are the right products being offered and can the people who need solutions the most actually pay for them? Knowing this is critical for providing more effective off-grid solutions and for companies to sustainably grow.

Fraym has developed several methods for understanding a households’ ability to pay for any good—including off-grid power. For example, we analyzed the ownership of certain household assets – radios and mobile phones – and the historical expenditures on local power substitutes. What we’ve found is that, of the unconnected households on the continent, more than half – 55 percent – do not own assets that indicate an ability to pay for off-grid energy solutions.

This part of the story is key. Six hundred million people are unconnected to the grid, but 330 million of them are currently not in a position to be able to pay for the solutions presently available to them.

The same proportion of the unconnected population – more than 50 percent – is concentrated in six countries. Five of these six countries share traditional borders, suggesting the need for solutions that can be integrated regionally.

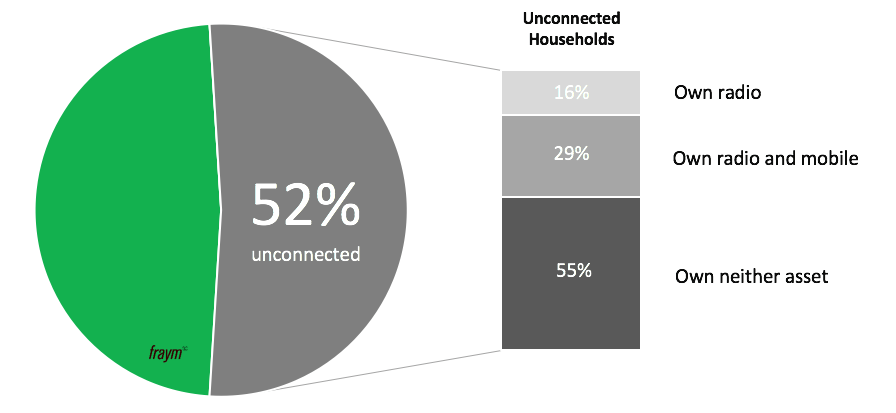

But we also know that more than 270 million unconnected Africans own a radio, with some 170 million owning both a radio and mobile phone; suggesting an ability to pay for at least entry-level home solar systems such as simple solar lanterns and appliances. The image below demonstrates what the need and ability to pay look like in some established and emerging off-grid markets on the continent.

Indications of Ability to Pay

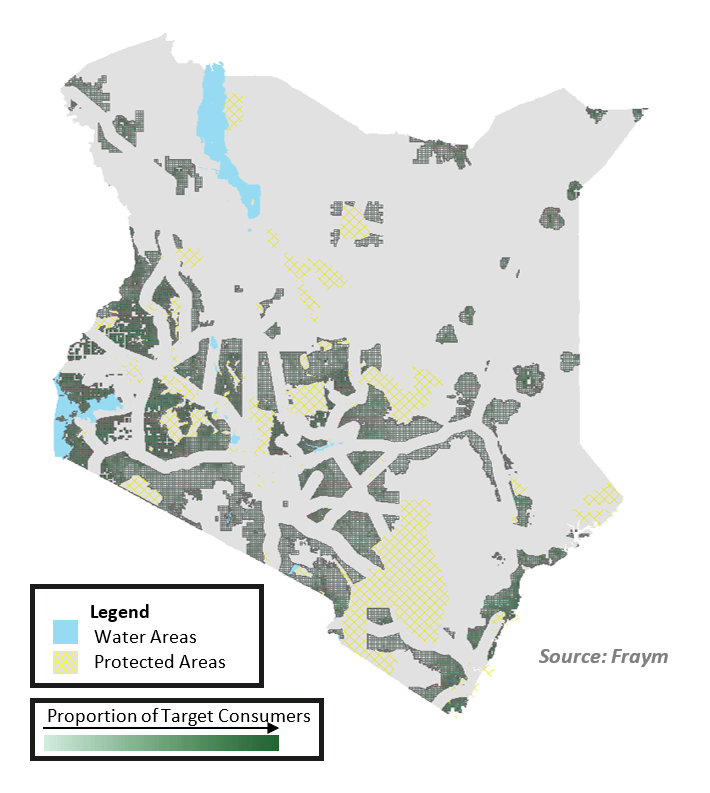

And this is just beginning—even more critical is understanding demand and ability to pay at a highly subnational level, displayed in the image below.

Target Off-Grid Consumers in Kenya

With this kind of context, Kupanda Capital and its partners will be able to better develop financing models that more accurately capture the financial limitations of these off-grid customers. Every unconnected household in Kenya, for example, is different and often solutions need to be provided in places that don’t fit inside traditional borders. Having the ability to hyper target commercial applications and then build corresponding financial structures at scale will be a game changer for this emerging sector.

Continue watching this space for more thoughts on data-driven ways to accelerate off-grid sector growth in Africa.