Build Effective Social and Behavior Change Strategies

East Africa’s largest retail supermarket chain is in trouble. Kenya-based Nakumatt filed for bankruptcy in October after a wave of store closures across Kenya and Uganda. The company’s future is now before Kenya’s High Court, with a decision expected in the coming weeks.

What caused Nakumatt’s financial problems? Company officials point to a 2010 expansion plan that inaccurately forecasted the economic profile of their target consumers. In this plan, Nakumatt expected very high, sustained economic growth rates in East Africa, particularly in Kenya. Under this hypothesis, they projected rapidly growing household incomes and spending, and thereby, significantly higher company revenues. To meet this expected new demand, Nakumatt opened more stores, expanding from 36 branches in 2010 to 62 across East Africa by 2016. But the growth in demand didn’t materialize at these levels.

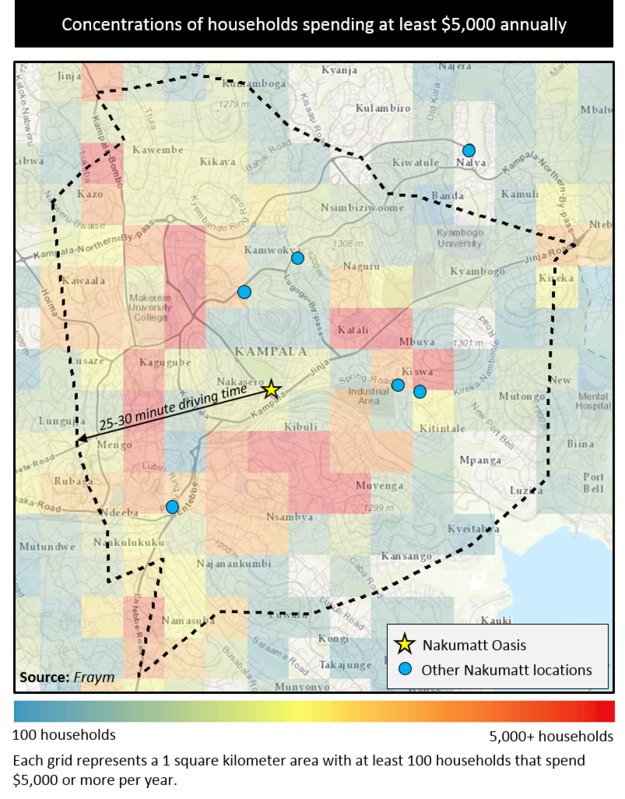

By 2016, nine of these 62 stores were in Uganda – with eight of them in Kampala alone. However, the Kampala stores were some of the first to close during the “branch culling” strategy that began this spring in an effort to save on operational costs. For further insight into Nakumatt’s difficulties, we looked closely at the now closed Oasis Mall location to see if data about the store’s catchment area could tell us about its demise. The location was supposed to be the best performing in Kampala, but Nakumatt’s management reported that the Oasis location frequently saw few or no customers.

For this analysis, we define the catchment area as anyone living within 5-6 kilometers, or a 25-30 minute drive. We found that the households within this zone show strong relative wealth and demand for Nakumatt products. For example:

These figures suggest that the Nakumatt Oasis store should have been in an optimal location. So what happened?

Our map suggests overconcentration. There are five additional Nakumatt locations within the Oasis store’s catchment area, and one more store right outside of it. In addition, there are multiple competitor stores in the same area. The decision to open five Nakumatts in this location was likely an attempt to capture the opportunity demonstrated by the demographic, expenditure, and income levels within the area. But with reports that the “best performing store” in Kampala often saw few customers, it is clear that Nakumatt cannibalized its own market share.

This likely explains Nakumatt’s current predicament much more than the excuse of poor management and low revenue. At Fraym, we use geospatial data about African consumers – how they purchase, where they purchase, and their ability to pay for products – to help retailers make informed decisions about their next move. Detailed mapping might have saved Nakumatt from opening too many store locations that competed for the same customers.

[1] At an exchange rate of 3,417 Ugandan shillings to 1 US dollar (2016 nominal average exchange rate)

[2] Comparable household characteristics for Kampala are as follows: