Build Effective Social and Behavior Change Strategies

Financial inclusion is widely recognized by policy makers as a critical component to economic development. To encourage progress, many African countries have established goals that aim to increase access to financial services. Recent developments in banking, such as mobile money, digital banking, and agent banking, offer a path toward greater inclusion. The question is, how do financial services companies strategically expand to rural communities?

Fortunately, recent technological advancements make it possible to get hyper-local insights for areas where data has been traditionally hard to obtain. Satellite imagery, household surveys, and cloud computing can be used to reveal population characteristics in countries, cities, and neighborhoods across the entire African continent, even down to the 1km2 level. Instead of working with aggregated data and static imagery, we can now illuminate specific areas of interest.

Applications for this type of data are vast and cross sectors. To get a sense for its power, let’s apply it to the financial inclusion challenge. Due to Nigerian government lending targets and incentive programs, many banks are establishing business strategies for specific groups, such as smallholder farmers. Built to make the retrieval of consumer data easy, the cutting-edge platform dataFraym can help us identify and locate concentrations of target customers in rural Nigeria. An enterprise-wide geospatial data service allows banks to: identify concentrations of smallholder farmers; understand crop production and seasonal income patterns; analyze preexisting financial services usage; and overlay marketplaces where farmers may congregate on specific days.

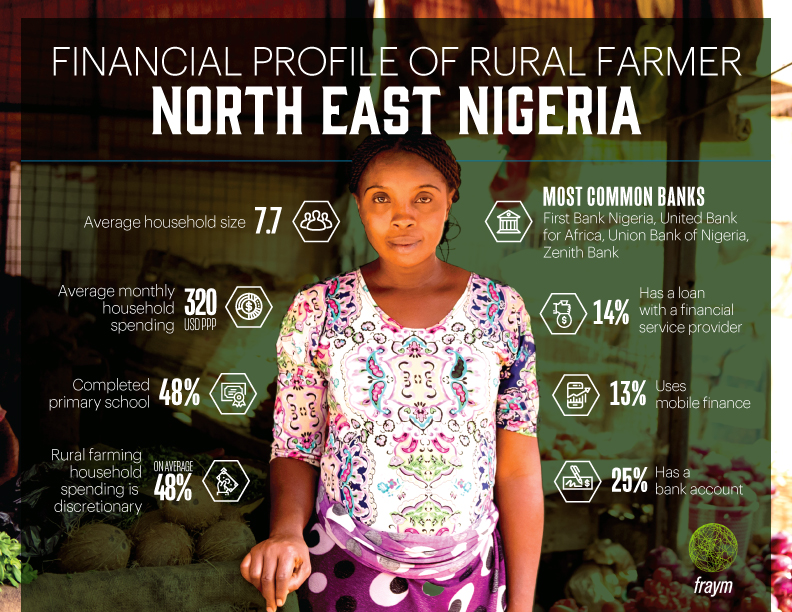

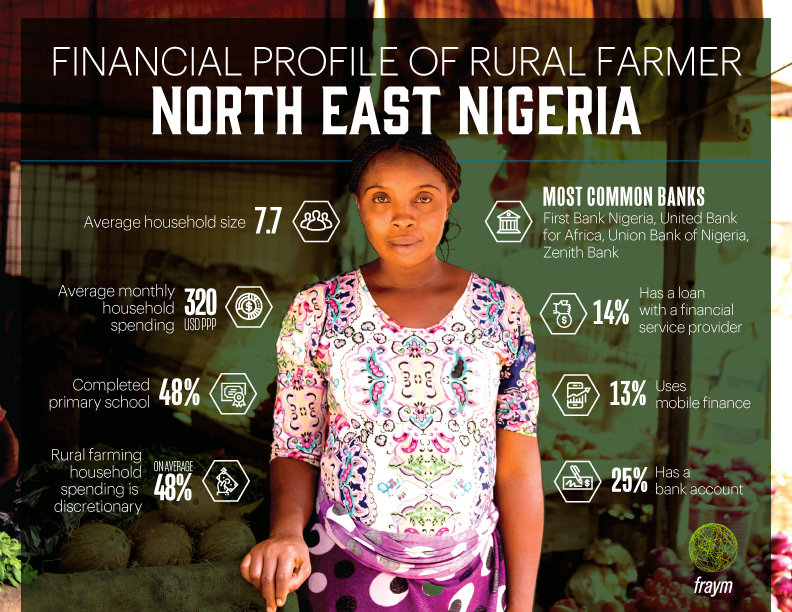

Almost 100 million Nigerians live in rural areas, with the vast majority living in households engaged in farming activity. We know financial inclusion is a major barrier to prosperity for these rural farming household as formal bank branches are typically located in cities, and rural customers have often been seen as less lucrative for financial products. However, Fraym data shows that rural farmers have the same level of demand for financial services as urban residents.

With limited access to a formal banking sector, to date rural farmers have tended to rely on informal lending networks to meet their financial needs. In fact, 47 percent of all rural farming households report borrowing money from outside the household at least once in the past year and 57 percent report saving in some form. These rates of borrowing and saving are similar amongst urban households. The key differences lie in the sources of credit and savings.

About 14 percent of rural farmer borrowing happens in the formal financial space. This low level of formal borrowing is actually similar in urban settings. However, rates of formal sector savings are much lower in rural areas. One third of rural farmers who save do so in a bank, compared to two thirds of urban households with savings. Instead of saving in banks, rural farmers tend to use informal networks. This is notably higher than urban residents, where less than half save in the form of cash at home.

The lack of banks in rural settings can also help explain the low use of formal financial products. 62 percent of farmers report living more than five kilometers away from a bank. This distance creates a barrier to formal financial use—only 20 percent of rural farmers have a bank account, compared to 42 percent of urban residents. Almost 70 percent of farmers without bank accounts report that they haven’t opened a bank account because there are no banks nearby.

As you can see, this detailed, spatial data delivers invaluable insights that answer questions like, ‘what do people in a specific area look like’, ‘what do they buy’, and ‘how do they behave’. By incorporating information about people’s needs and whereabouts into growth strategies and operational planning, you can pioneer the way toward more successful outcomes for African businesses and communities.