Build Effective Social and Behavior Change Strategies

African consumers are the global leaders in the adoption of digital financial services like mobile money. Yet traditional banks and emerging digital providers both continue to grapple with how to expand financial inclusion. It can be expensive and difficult for financial services providers to figure out the most useful product offering and understand the market. Most providers find themselves with two options: expensive primary data collection or blindly introduce a product to the market and see what happens.

At Fraym, we’ve been thinking about how to approach this in a more strategic and efficient way. By harnessing our comprehensive demographic, expenditure, and geospatial data, we can determine who’s ready for a digital financial services product – the optimal customer – and where providers should target.

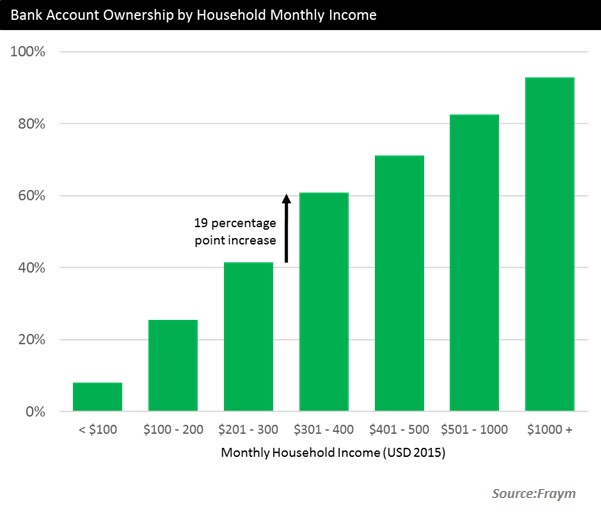

For instance, by looking at monthly household income and existing rates of financial service adoption in Tanzania, we found that the largest increase in new bank account ownership occurs when monthly household income rises from $200-300 to $300-400 per month.

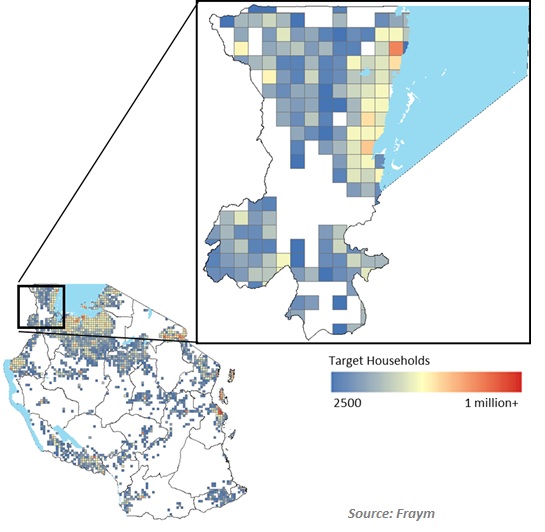

We then estimated the number of new potential account holders in 10×10 km grids throughout the country, locating those places where the most potential customers were currently underserved.

For example, we found that only 19 percent of people living in the Kagera region have a financial account, but 40 percent of the population fit the profile of a Tanzanian account holder, earning between $200-400 USD month.

The role of data analytics approaches like these is vital as firms pursue new digital products in Africa and globally. Last week, we discussed the different ways Fraym uses data to improve product development and financial service market expansion in Africa. We were invited by our partner, the International Finance Corporation, to speak at the launch of their 2017 Data Analytics and Digital Financial Services Handbook, which serves as a practical guide on how to leverage data for developing products, managing operations, and using data-driven credit scoring models.

We look forward to joining the IFC and others in the pursuit of the best data-driven techniques to accelerate digital financial inclusion in Africa.